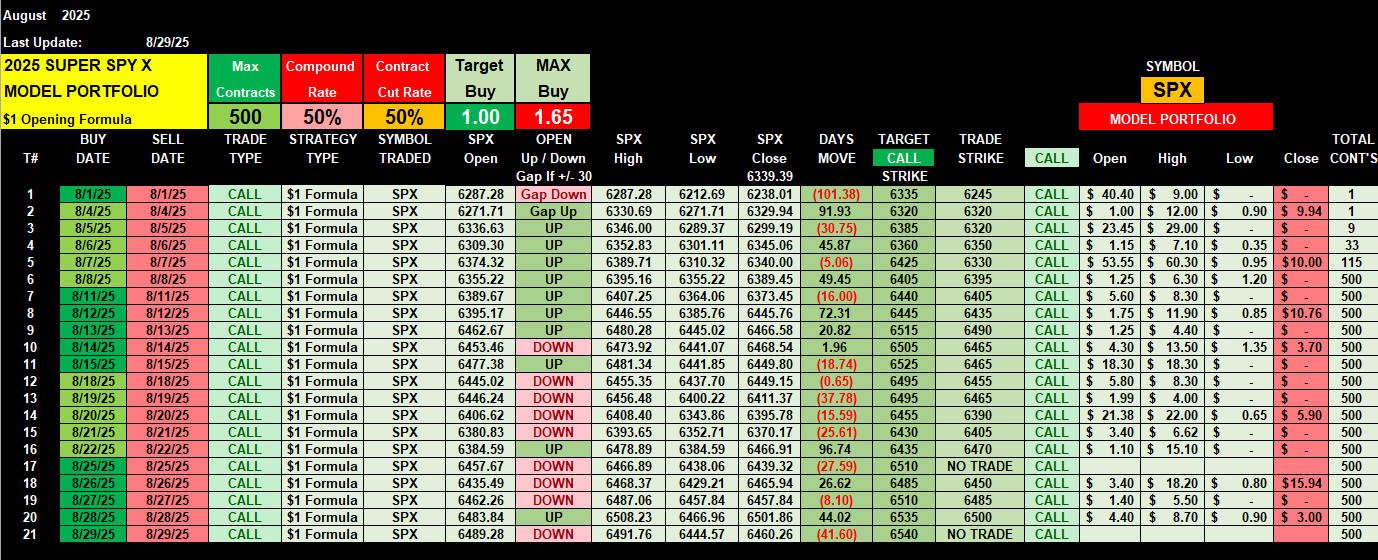

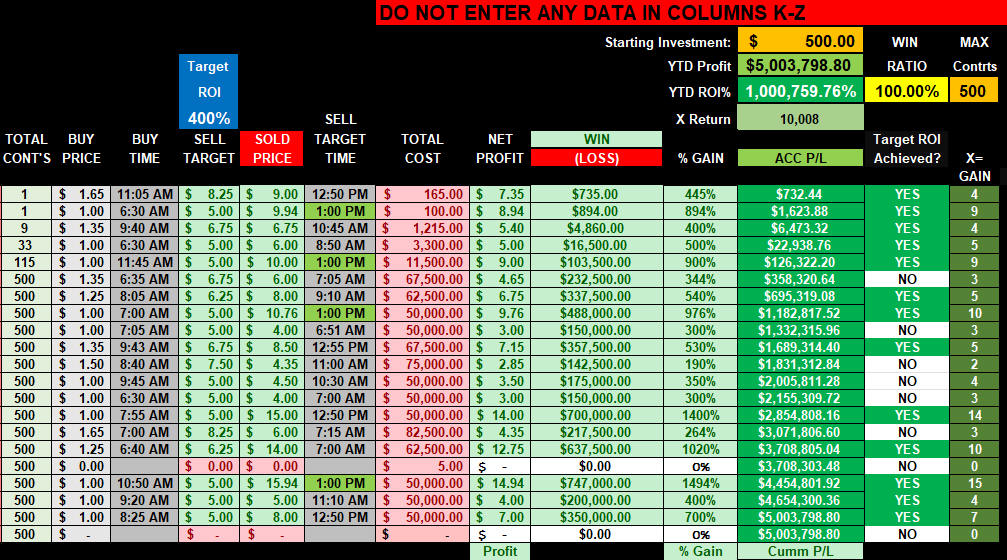

Aug 2025 CALL Model Portfolio Spreadsheet Results made up to $5 MILLION!

This spreadsheet is based on documented trade activity that fit the SuperSPY-SPX $1 Opening Formula strategy.

It has the benefit of hindsight pertaining to the HOD prices; however, the entry prices are based on a fixed "SPEND" target each trade.

The target ROI was set at 400% and has a documented 99% win rate, and when coupled with the SSX compounding formula, it can produce similar amazing ProfitsUP!

The SPX has massive predictable moves day-to-day; which allows you to rapidly compound; and that is what rockets your account to the land of 7-Figure profitability in potentilally a single month of trading the SuperSPY-SPX $1 Opening Formula!

This data clearly shows you that you can indeed make substantial ProfitsUP! if you learn the formula, apply the stratey, compound your contracts and layer exits and you can achieve similar results!

Here are all the day-by-day option charts to PROVE the Formula worked, works and will keep on working!

8/1/25 - SPX

OPEN - 6287.28 / HI - 6287.28 / LO - 6212.69 / CLOSE — 6238.01 (-101.38 -1.60%) — Days Range: 74.59

$1.00 Opening Formula Strike Ranges: CALLS 6335 / PUTS 6235

Strike Traded: 6245 CALL

============================================================================================================================

AUG 4 , 2025 SPX -

OPEN - 6271 / HI - 6330.69 / LO - 6271.71 / CLOSE - 6329.94 +91.93 +1.47% — Days Range: 58.98

$1.00 Opening Formula Strike Ranges: CALLS 6320 / PUTS 6220

=========================================================================================================================================

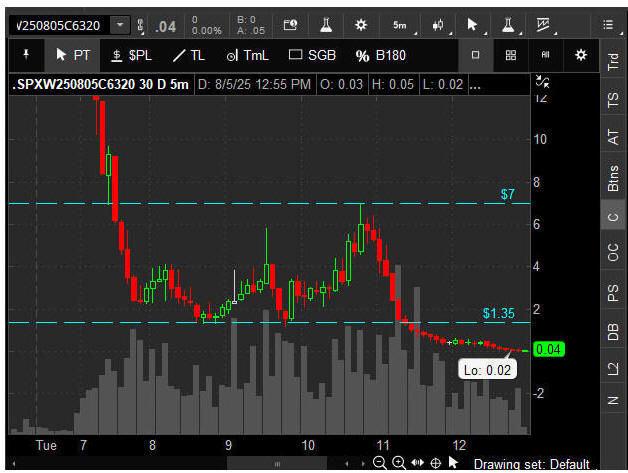

AUG 5, 2025 SPX -

OPEN - 6336.63 / HI - 6346.00 / LO - 6289.37 / CLOSE - 6299.19 -30.75 -0.49% — Days Range: 56.63

$1.00 Opening Formula Strike Ranges: CALLS 6320 / PUTS 6220

Traded Strike: 6320 CALL

=====================================================================================================

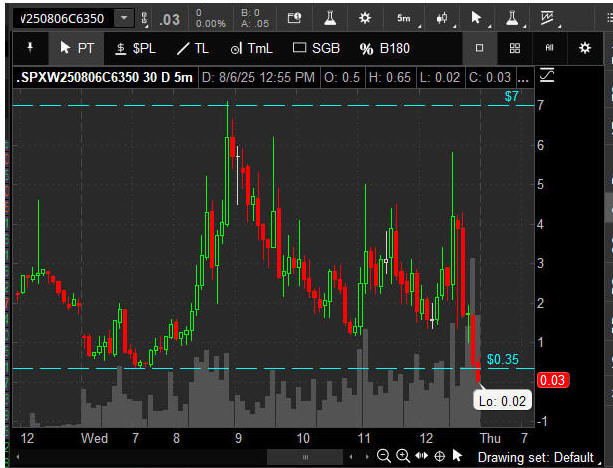

AUG 6, 2025 SPX -

OPEN - 6309.30 / HI - 6352.83 / LO - 6301.11 / CLOSE - 6345.06 +45.87 +0.73% — Days Range: 51.72

$1.00 Opening Formula Strike Ranges: CALLS 6360 / PUTS 6260

Traded Strike:

======================================================================================================================================

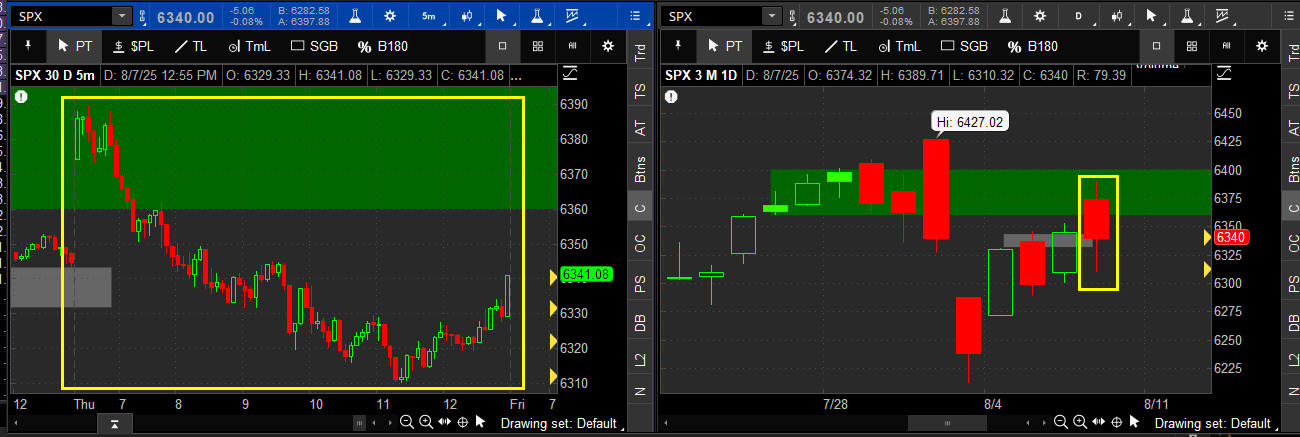

AUG 7, 2025 SPX -

OPEN - 6374.32 / HI - 6374.32 / LO - 6310.35 / CLOSE - 6340.00 -5.06 -0.08 0% — Days Range: 79.39

$1.00 Opening Formula Strike Ranges: CALLS 6440 / PUTS 6340

Traded Strike: 6330C

=====================================================================================================================

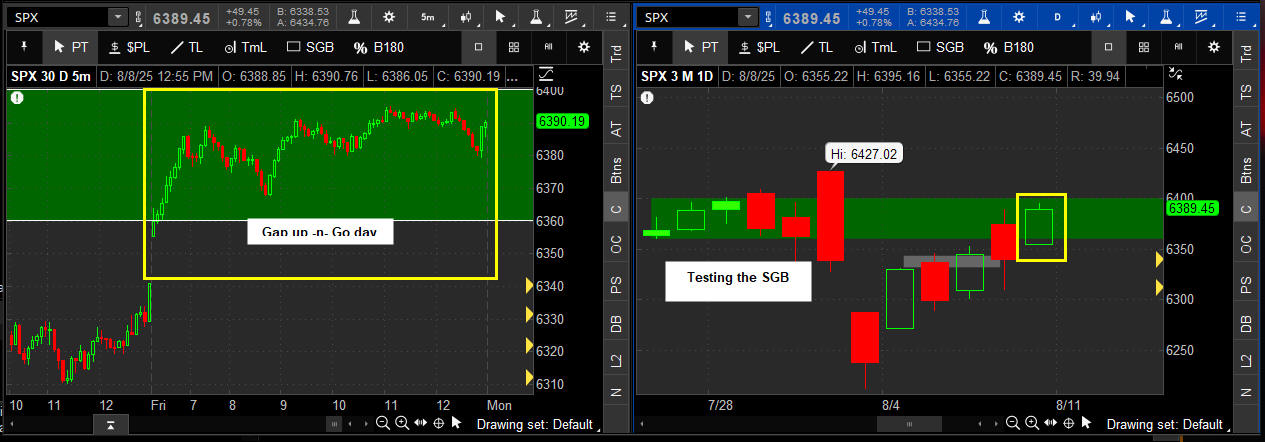

AUG 8, 2025 SPX -

OPEN - 6355.22 / HI - 6395.16 / LO - 6355.22 / CLOSE - 6389.45 +49.45 +0.78% "Fibonacci 89!" — Days Range: 39.94

$1.00 Opening Formula Strike Ranges: CALLS 6405 / PUTS 6305

Traded Strike: 6395 CALL

=========================================================================================================================

AUG 11, 2025 SPX -

OPEN - 6389.67 / HI - 6407.25 / LO - 6364.06 / CLOSE - 6373.45 ( -16.00 -0.25%) — Days Range: 58.98

$1.00 Opening Formula Strike Ranges: CALLS 6440 / PUTS 6340

Today the Formula strike(s) were out of the buy range $1.00 - $1.65 but based on the overall moves and news, the EOD opportunites were well worth the risk/reward and once you have profits up (especially like the model portfolio trading at 500 contract loads now) you have options to expand your strike universe and make other trades to advance your jounrey.

Traded Strike: 6405 CALL

================================================================================================================================

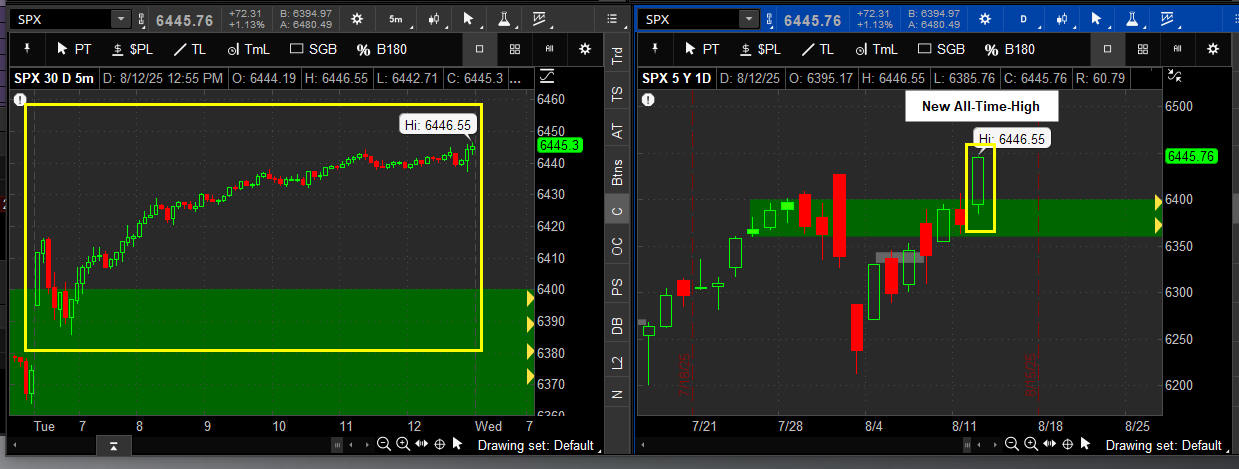

AUG 12 , 2025 SPX -

OPEN - 6395.17 / HI - 6446.55 (Fibonacci "55") / LO - 6385.76 / CLOSE - 6445.76 +72.31 +1.12% — Days Range: 56.09

$1.00 Opening Formula Strike Ranges: CALLS 6440 / PUTS 6340

Traded Strike: 6435 C

=============================================================================================================================================

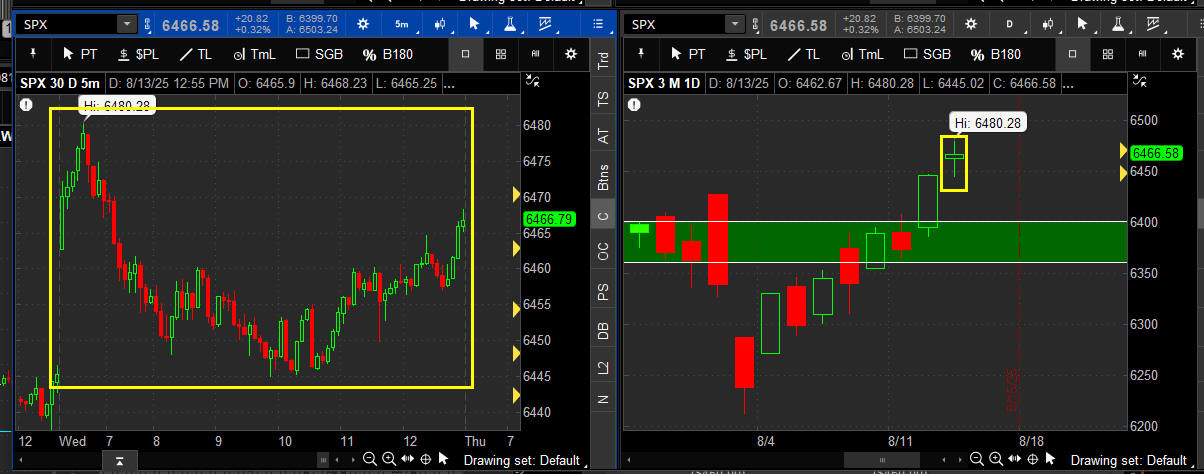

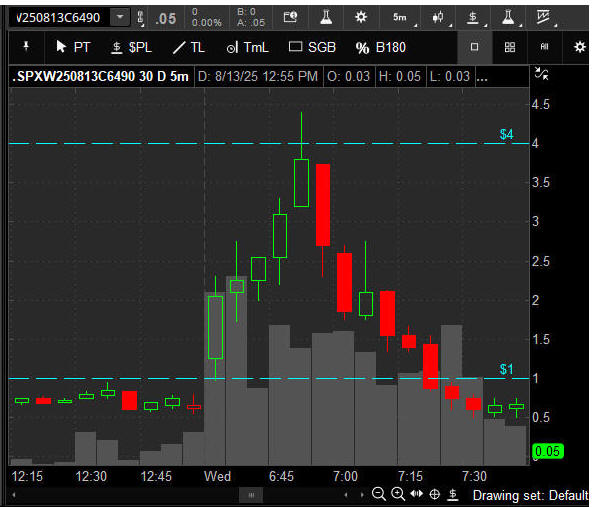

AUG 13 , 2025 SPX -

OPEN - 6462.67 / HI - 6480.28 / LO - 6445.02 / CLOSE - 6466.58 +20.82 +0.32% — Days Range: 35.26

$1.00 Opening Formula Strike Ranges: CALLS 6515

Traded Strike: 6490 CALL

=========================================================================================================================================

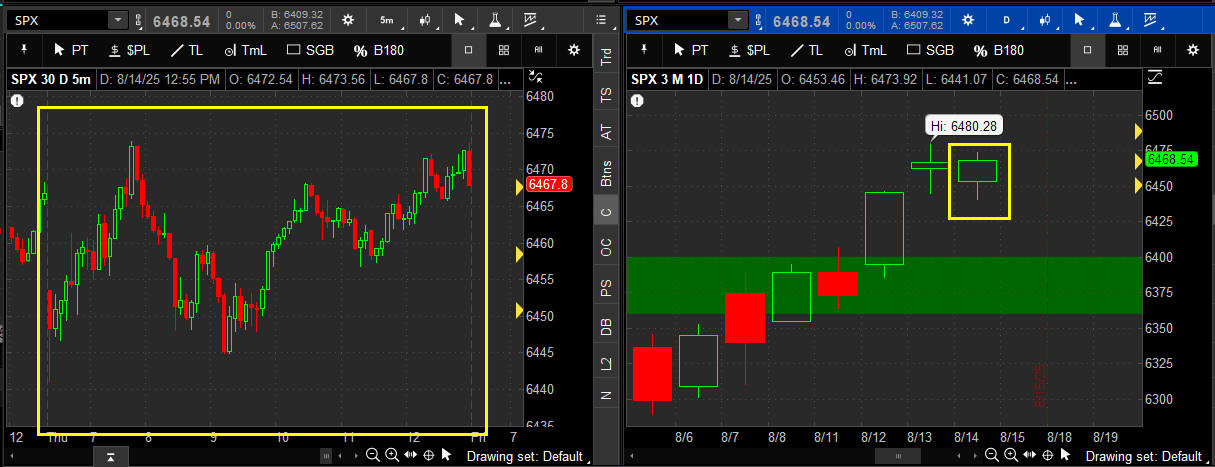

AUG 14 , 2025 SPX -

OPEN - 6453.46 / HI - 6473.92 / LO - 6441.07 / CLOSE - 6468.54 +1.93 0.03% — Days Range: 32.85

$1.00 Opening Formula Strike Ranges: CALLS 6505 / PUTS 6405

Traded Strike: 6465 CALL

====================================================================================================================================

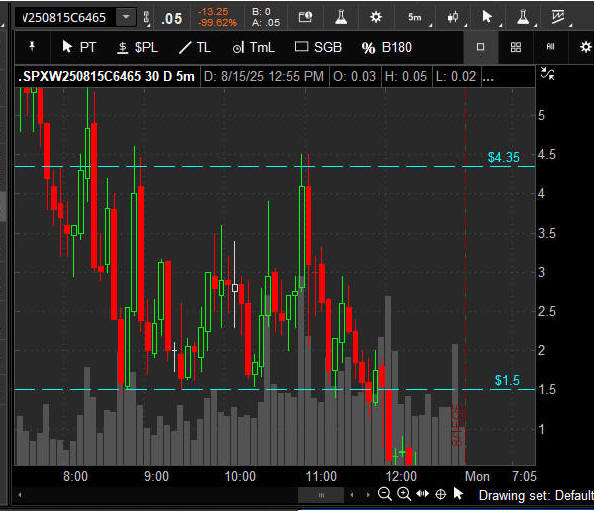

AUG 15 , 2025 SPX -

OPEN - 6477.38 / HI - 6481.34 / LO - 6441.85 / CLOSE - 6449.80 (-18.74 -0.29%) — Days Range: 39.49

$1.00 Opening Formula Strike Ranges: CALLS 6525 / PUTS 6425

Traded Strike: 6465 CALL

AUG 18, 2025 SPX -

OPEN - 6445.02 / HI - 6455.35 (Fibonacci "55") / LO - 6437.70 / CLOSE - 6449.15 (-0.65 -0.01%) — Days Range: 17.65

$1.00 Opening Formula Strike Ranges: CALLS 6495 / PUTS 6395

Traded Strike: 6445 CALL

=======================================================================================================================================

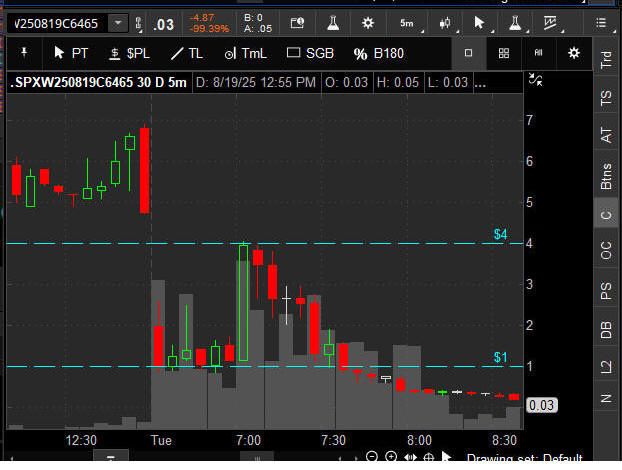

AUG 19 , 2025 SPX -

OPEN - 6446.24 / HI - 6456.48 / LO - 6400.22 / CLOSE - 6411.37 (-37.78 -0.59%) — Days Range: 56.26

Perfect down day stopping exactly on my SGB zone!

$1.00 Opening Formula Strike Ranges: CALLS 6495 / PUTS 6395

Traded Strike: 6455 CALL

=======================================================================================================================================

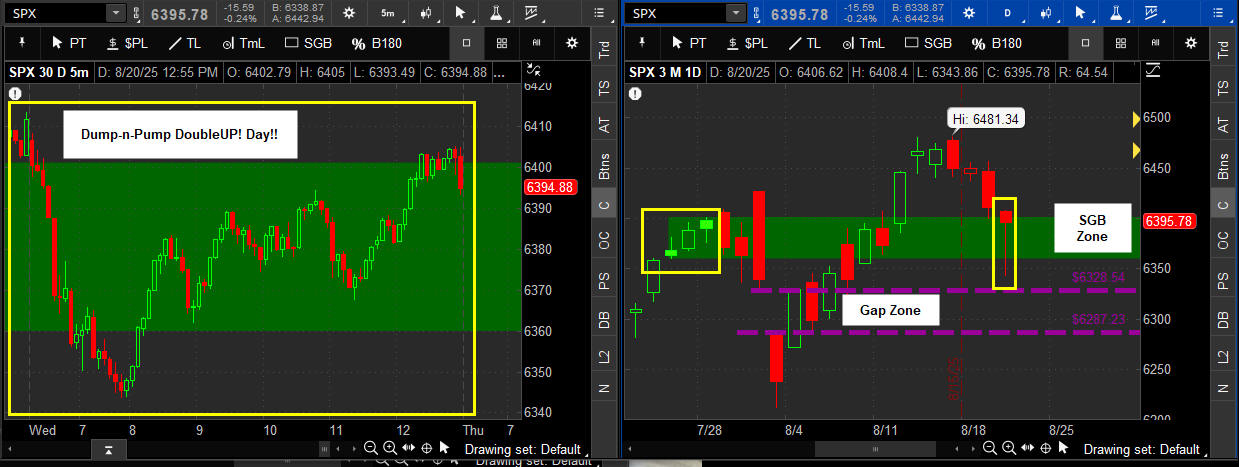

AUG 20 , 2025 SPX -

OPEN - 6406.62 / HI - 6408.40 / LO - 6343.86 / CLOSE - 6395.78 ( -15.59 -0.24%) — Days Range: -- 64.54

$1.00 Opening Formula Strike Ranges: CALLS 6455 / PUTS 6355

Traded Strike: 6390 CALL

====================================================================================================================================================

AUG 21, 2025 SPX -

OPEN - 6380.83 / HI - 6393.65 / LO - 6352.71 / CLOSE - 6370.17 ( -25.61 -0.40% ) — Days Range: 40.94

$1.00 Opening Formula Strike Ranges: CALLS 6430 / PUTS 6330

Traded Strike: 6405 CALL

==================================================================================================================================================

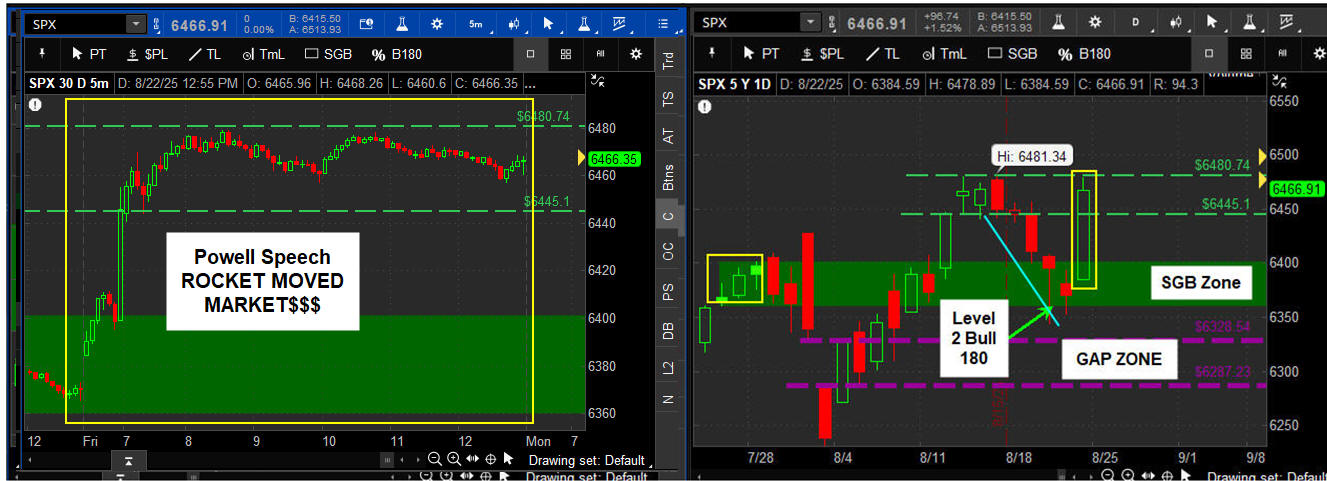

AUG 22 , 2025 SPX -

OPEN - 6384.59 / HI - 6478.89 / LO - 6384.59 / CLOSE - 6466.91 +96.74 +1.52% — Days Range: 58.98sterday, I poined

Powell speech day from Jackson Hole symposium cause a ROCKET MOVE -- Cha-CHING!!!

$1.00 Opening Formula Strike Ranges: CALLS 6430 / PUTS 6330

Traded Strike: 6470 CALL

======================================================================================================================

AUG 25 , 2025 SPX -

OPEN - 6457.67 / HI - 6466.89 / LO - 6438.06 / CLOSE -6439.32 (-27.59 -0.43%) — Days Range: 28.83

So far, there was no follow through after Friday's Powell speech launch. The target bounce test is my SGB zone at 6400 and a breakout move over 6489. Wednesday is NVDA earnings so I am anticipating another measured move is coming by Friday. Target strike ranges are 6360 PUT and 6550 CALL.

$1.00 Opening Formula Strike Ranges: CALLS 6510 / PUTS 6410

NO TRADE STRIKES FIT THE $1 FORMULA RANGE.

======================================================================================================================================

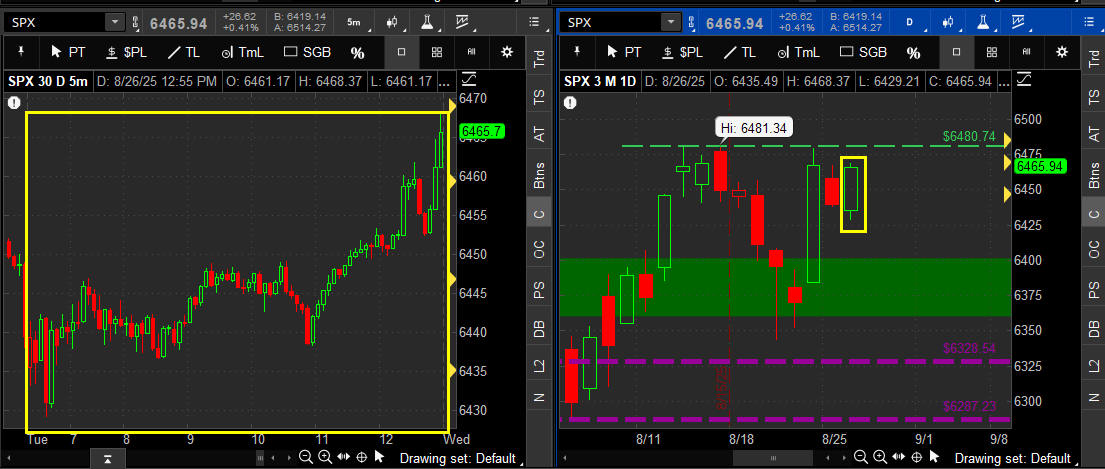

AUG 26 , 2025 SPX -

OPEN - 6435.49 / HI - 6468.37 / LO - 6429.21 / CLOSE - 6465.94 +26.62 +0.41% — Days Range: 39.16

Comments from Trump this afternoon that he "We'll have a majority very shortly," in the FOMC created a strong surge squeeze into the close $$$$$$$$$

You have to be in it to win it every day becuase you never know when Trump will rocket the markets!

$1.00 Opening Formula Strike Ranges: CALLS 6485 / PUTS 6385

TRADED STIKE: 6450 CALL "HALF #"

============================================================================================================================

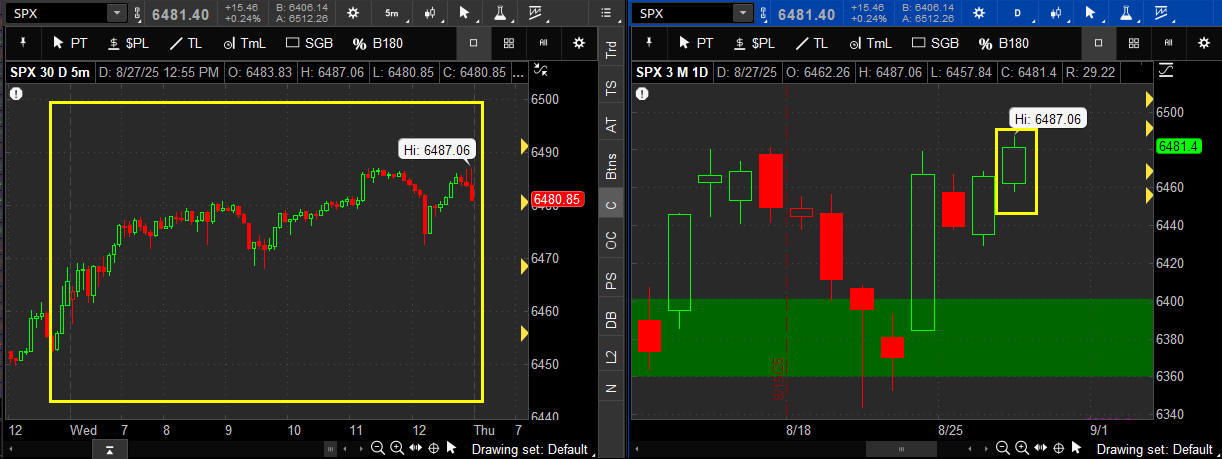

AUG 27 , 2025 SPX -

OPEN - 6462.26 / HI - 6487.06 / LO - 6457.84 / CLOSE - 6457.84 +15.46 +0.24% — Days Range: 29.22

$1.00 Opening Formula Strike Ranges: CALLS 6510 / PUTS 6410

TRADED STRIKE: 6485 CALL - FIT FORMULA AND HAD ORANGE DOTS SQUEEZE!

========================================================================================================================================

AUG 28 , 2025 SPX -

OPEN - 6483.84 / HI - 6508.23 / LO - 6466.96 / CLOSE - 6501.86 +20.46 +0.3% — Days Range: 41.27

Markets shrugged off NVDA earnings and grinded up all day closing at new all-time-highs once again. Tomrrow is month end and Monday markets are closed for Labor Day so there should be some good volatitliy and maybe we get a Moby Dick day!!!

$1.00 Opening Formula Strike Ranges: CALLS 6535 / PUTS 6435

TRADED STRIKE: 6500 CALL "WHOLE #"

====================================================================================================================================

AUG 29, 2025 SPX -

OPEN - 6489.58 / HI - 6491.76 / LO - 6444.57 / CLOSE - 6460.26 (-41.60 -0.64%) — Days Range: 57.19

End of month drop day with a little bump into the close. If we get continuation on Tuesday, I am targeting my SGB zone at 6400 for the next bounce level.

$1.00 Opening Formula Strike Ranges: CALLS 6540 / PUTS 6440

NO STRIKES FIT THE $1 FORMULA RANGES....NO CALL TRADES TODAY.

August's journey to 7-Figures has arrived...are you going to join me?

Here is the potential if you increase the formula to different MAX contract loads:

Review all the results for 2025 YTD here

IMPORTANT!: If you trade both CALLS and PUTS, I highly recommed you trade them on separate compounding spreadsheets and bankrolls.

Over the course of a month/year, both sides can take you well beyond the land of 7-Figure profitability becuase there are virtually NO LIMITS on how many contracts you can buy when trading SPX options!

When it comes to compounded contract size, there are pretty much NO LIMITS trading SPX options.

The limits are only your emotional ability to put on the larger contract size and then let the Super SPY-SPX strategies take you to a money tree of wealth!

Profits Up!

.

The donFranko

|

©1999-2025 www.OptionRadio.com All rights reserved.

Privacy Statement Terms of Service Disclaimer

|

|

© 1999-2025 OptionRadio.com All Rights Reserved.

Reproduction without permission is prohibited.

U.S. Government Required Disclaimer - No profitability nor performance claims of any kind are being made on this entire website, email distributions or recorded content. All information provided herein is for educational purposes only and should not be construed as investment advice. Site visitors are advised that trading is a high-risk, speculative activity and that generally expected customer results are that all traders will incur trading losses, regardless of the training they may receive and will not become profitable. You accept all liability resulting from your trading decisions; we assume no responsibilities for your trading results. All sales are final for all products and services sold and no refunds are offered. We are not an investment advisory service, nor a registered investment advisor. No individual advice nor trading management services of any kind are provided, therefore no member nor subscriber should assume that their participation in the services provided herein serves, nor is suitable as, a substitute for ongoing individual personalized investment advice from an investment professional chosen by the member/subscriber. Nothing in our website shall be deemed a solicitation or an offer to buy nor sell stocks, currencies, futures, options or any other instrument. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed on our site. Also, the past performance of any trading methodology is not necessarily indicative of future results.

CFTC RULE 4.41 - HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY, SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.

Site visitors, email subscribers and customers hereby agree to all terms found in our complete disclaimer, terms of use and privacy policy pages. Every visitor to this site, and subscriber (or prospective subscriber or customer) acknowledges and accepts the limitations of the services provided, and agrees, as a condition precedent to his/her/its access to our sites, to release and hold harmless OptionRadio, its officers, directors, owners, employees and agents from any and all liability of any kind (including but not limited to his/her viewing of this sites' content, emails, subscription to services and/or purchase of any trader training product or service herein). Trade with discipline and you will have smarter, winning trades. |