SEP 16, 2025 SPX -

OPEN - 6624.13 / HI - 6626.99 / LO - 6600.11 / CLOSE - 6606.76 -8.52 -0.13% — Days Range: 26.88

Tomorrow is a very important FOMC rate change announcement. It is priced in there will be a -0.25% cut, but overatures from the Trump administration is attempting to leverage Powell to cut at least -0.50%—now if that happens, we could see a massive multi-day move.

Depending on how Powell reacts at the press conference, we will get a measured move up or down. If Powell does a rug pull on Trump and NO rate cut or does expected -0.25 then goes total hawk at the Q&A, we could be in for a massive multi-day implosion. On the other hand, if he does a kiss-the-ring moment...Ha Ha ;-) ...but goes extra dovish and even mentions potential QE, then we should anticipate RISK-ON and markets rocket higher in by Friday.

Either outcome, I am hopeful there will be at least a 100 point move if not tomrorow, then by Friday so we can bank up a huge Moby Dick ProfitsUP!

Interestingly enough, today's close ended basically at "666" as I predicted last week even though I expected a run to 6,666.66. I am not splitting hairs here, but simply pointing out some very peculiar anomolies / correlations with closing prices (which are manipulated) and what I call "code" insider info signaling.

If the move is lack-luster post Powell, then I will be paying very close attention to any move up to 6,666.66 as that could be the very TOP for the rest of the year.

I expect a tight range morning, and I am currently straddled with spreads. I have 6575 / 6565 DITM CALL spreads that expire tomorrow and 6660 / 6665 DITM PUT spreads that expire on Friday.

Once we get the annoucement, statement and conference, then I will be prepared to add more spreads and take my postions on Lotto Trades. Because there is a lot more IV pump, we will not be able to get the $0.05 - 0.25 entry prices inside a 100 strike ranges; and the price to play is substantially higher.

If you have a small account, you are priced out on this FOMC round, but one way to participate is with DITM spreads or just wait until the EOD Lotto Trades and hope for a nice pump or dump in the final minutes of the trading session.

The other way to participate is trade the SPY, but remeber to divide the SPX price by 10 and then add at least 1 strike closer on SPY options.

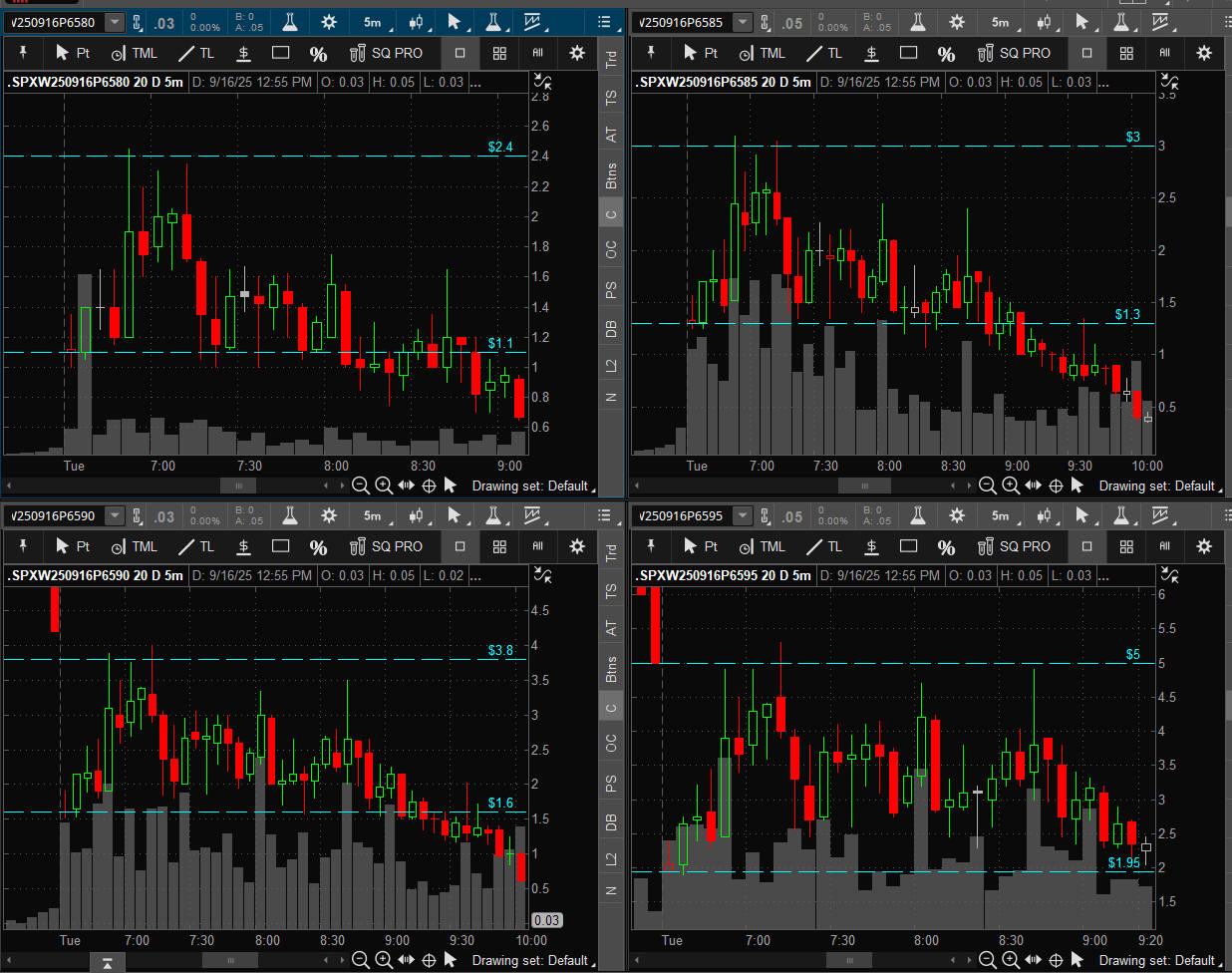

$1.00 Opening Formula Strike Ranges +/- 50 points: CALLS 6675 / PUTS 6575

Other strikes that fit the $1 Formula buy ranges:

All Multi-Strikes today:

===================================================================================================================

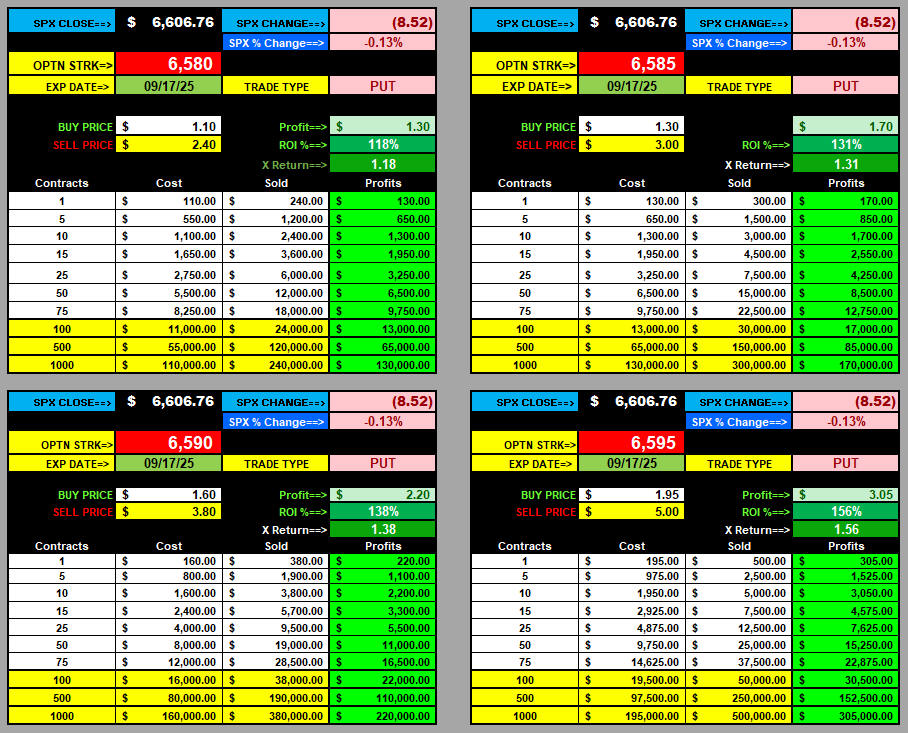

9-16-25 EOD LOTTO TRADES:

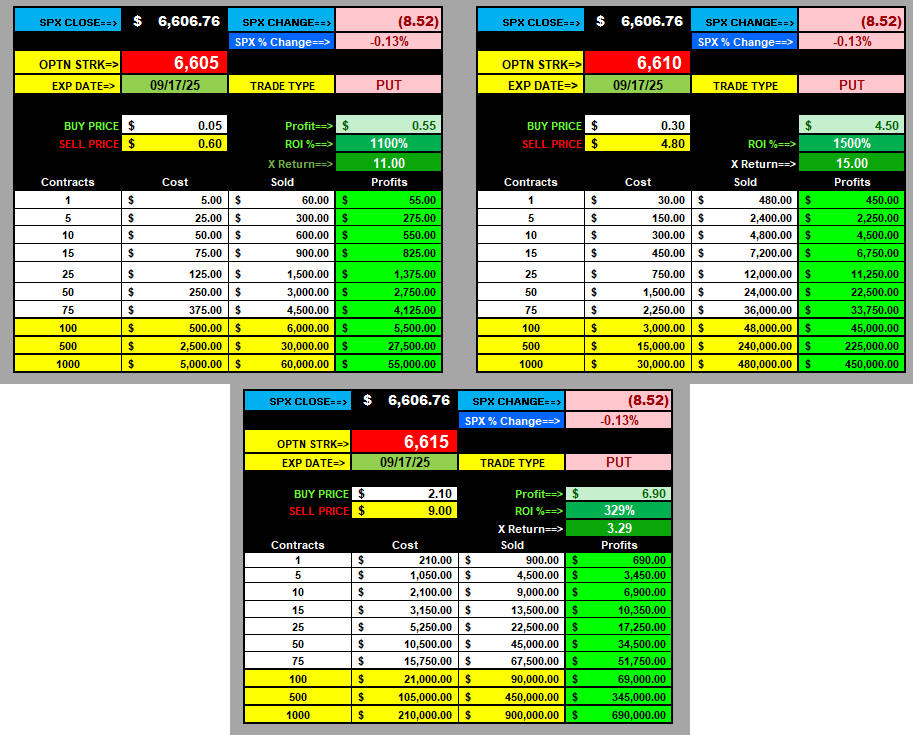

12:30 PM PST - Quant Pivot lines: Neutral =6610 H1= 6615 L1= 6605 — CLOSE - 6606.76 -8.52 -0.13%

Today, the 6605 PUT hit the $0.05 CENT and rocketed 10X. The 6610 also made an impressive 15X move.

Join me on the journey to the land of 7-Figure profitability today!

|

©1999-2025 www.OptionRadio.com All rights reserved.

Privacy Statement Terms of Service Disclaimer

|

|

© 1999-2025 OptionRadio.com All Rights Reserved.

Reproduction without permission is prohibited.

U.S. Government Required Disclaimer - No profitability nor performance claims of any kind are being made on this entire website, email distributions or recorded content. All information provided herein is for educational purposes only and should not be construed as investment advice. Site visitors are advised that trading is a high-risk, speculative activity and that generally expected customer results are that all traders will incur trading losses, regardless of the training they may receive and will not become profitable. You accept all liability resulting from your trading decisions; we assume no responsibilities for your trading results. All sales are final for all products and services sold and no refunds are offered. We are not an investment advisory service, nor a registered investment advisor. No individual advice nor trading management services of any kind are provided, therefore no member nor subscriber should assume that their participation in the services provided herein serves, nor is suitable as, a substitute for ongoing individual personalized investment advice from an investment professional chosen by the member/subscriber. Nothing in our website shall be deemed a solicitation or an offer to buy nor sell stocks, currencies, futures, options or any other instrument. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed on our site. Also, the past performance of any trading methodology is not necessarily indicative of future results.

CFTC RULE 4.41 - HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY, SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.

Site visitors, email subscribers and customers hereby agree to all terms found in our complete disclaimer, terms of use and privacy policy pages. Every visitor to this site, and subscriber (or prospective subscriber or customer) acknowledges and accepts the limitations of the services provided, and agrees, as a condition precedent to his/her/its access to our sites, to release and hold harmless OptionRadio, its officers, directors, owners, employees and agents from any and all liability of any kind (including but not limited to his/her viewing of this sites' content, emails, subscription to services and/or purchase of any trader training product or service herein). Trade with discipline and you will have smarter, winning trades. |